Warner Bros. Discovery is cracking open the door to permit spurned bidder, Paramount Skydance, to make its case — however Warner’s board nonetheless maintains its desire for Netflix’s competing proposal.

Warner’s transfer to reopen talks comes after weeks of strain from Paramount, which submitted an enhanced supply to purchase Warner final week. Paramount’s willingness to extend its supply late within the public sale attracted the eye of some Warner traders.

On Tuesday, Warner Bros. Discovery responded with a letter to Paramount Chairman David Ellison and others on Paramount’s board, giving the group seven days to “make clear your proposal.”

“We search your greatest and closing proposal,” Warner board members wrote. Warner set a Feb. 23 deadline for Paramount to conform.

The intently watched sale of the century-old Warner Bros., identified for “Batman,” “The Massive Bang Concept,” “Casablanca,” and HBO, the house of “Recreation of Thrones” and “Succession,” is anticipated to reshape Hollywood.

The flurry of exercise comes as Warner Bros. Discovery and Netflix are searching for to enter the house stretch of the public sale. Warner individually issued its proxy and set a particular March 20 assembly of its shareholders to resolve the corporate’s destiny.

Warner Bros. Discovery is recommending that its stockholders approve the $82.7-billion Netflix deal.

“We proceed to consider the Netflix merger is in the perfect pursuits of WBD shareholders as a result of great worth it supplies, our clear path to attain regulatory approval and the transaction’s protections for shareholders towards draw back danger,” Warner Chairman Samuel A. Di Piazza, Jr., mentioned in a Tuesday assertion.

Nonetheless, the maneuver basically reopens the talks.

Warner Bros. is creating a chance for Paramount to sway Warner board members, which might maybe immediate Netflix to lift its $27.75 a share supply for Warner’s Burbank-based studios, huge library of programming, HBO and streaming service HBO Max.

Netflix will not be interested by shopping for Warner Bros. Discovery’s primary cable channels, together with CNN, TBS, HGTV and Animal Planet, that are set to be spun off to a stand-alone firm later this yr.

In distinction, Paramount desires to purchase your entire firm and has supplied greater than $30 a share.

Final week, Paramount sweetened its bid for Warner, including a $2.8-billion “break charge” that Warner must pay Netflix if the corporate pulled the plug on that deal. Paramount additionally mentioned it could pay Warner traders a “ticking charge” of 25 cents a share for each quarter after Jan. 1 that the deal doesn’t shut.

“Whereas we’ve got tried to be as constructive as doable in formulating these options, a number of of this stuff would profit from collaborative dialogue to finalize,” Paramount mentioned final week because it angled for an opportunity to make its case. “We’ll work with you to refine these options to make sure they deal with any and all your considerations.”

Netflix agreed to present Warner Bros. Discovery a brief waiver from its merger settlement to permit Warner Bros. Discovery to reengage with Paramount, which misplaced the bidding warfare on Dec. 4.

“We granted WBD a slim seven-day waiver of sure obligations underneath our merger settlement to permit them to interact with PSKY to totally and at last resolve this matter,” Netflix mentioned Tuesday in an announcement. “This doesn’t change the truth that we’ve got the one signed, board-recommended settlement with WBD, and ours is the one sure path to delivering worth to WBD’s stockholders.”

Netflix has matching rights for any improved Paramount supply. The corporate renewed its confidence in its deal and its prospect to win regulatory approval.

“PSKY has repeatedly mischaracterized the regulatory evaluation course of by suggesting its proposal will sail by means of, deceptive WBD stockholders about the true danger of their regulatory challenges world wide,” Netflix mentioned in its assertion. “WBD stockholders shouldn’t be misled into considering that PSKY has a neater or sooner path to regulatory approval – it doesn’t.”

Warner Bros. Discovery acknowledged that Paramount’s latest modification “addresses a number of the considerations that WBD had recognized a number of months in the past,” in response to the letter to Paramount.

However Warner Bros. Discovery added Paramount’s supply “nonetheless incorporates most of the unfavorable phrases and situations that have been within the draft agreements … and twice unanimously rejected by our Board,” Warner Bros. Discovery mentioned.

Warner’s board instructed Paramount it can “welcome the chance to interact” in the course of the seven-day negotiation interval.

Paramount has been pursuing the prized property since final September.

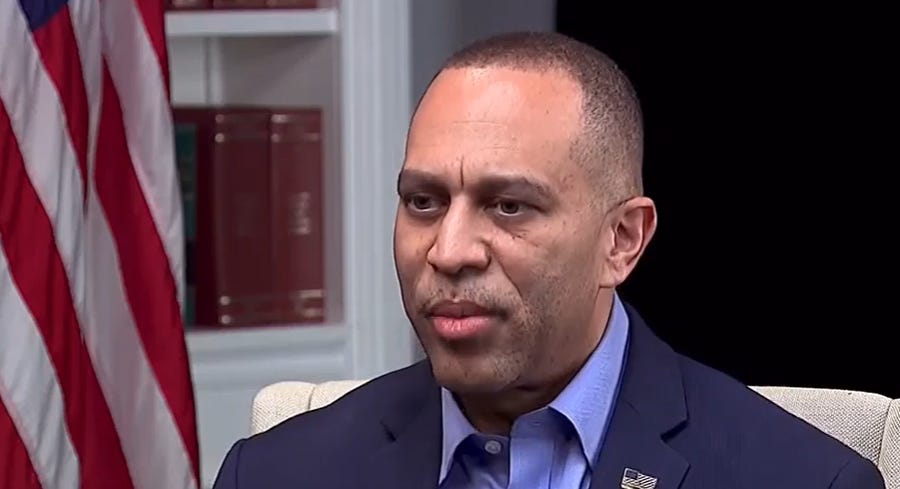

“Each step of the best way, we’ve got offered PSKY with clear path on the deficiencies of their gives and alternatives to handle them,” Warner Chief Government David Zaslav mentioned in an announcement. “We’re partaking with PSKY now to find out whether or not they can ship an actionable, binding proposal that gives superior worth and certainty for WBD shareholders.”